适用对象:品牌广告主和小店卖家

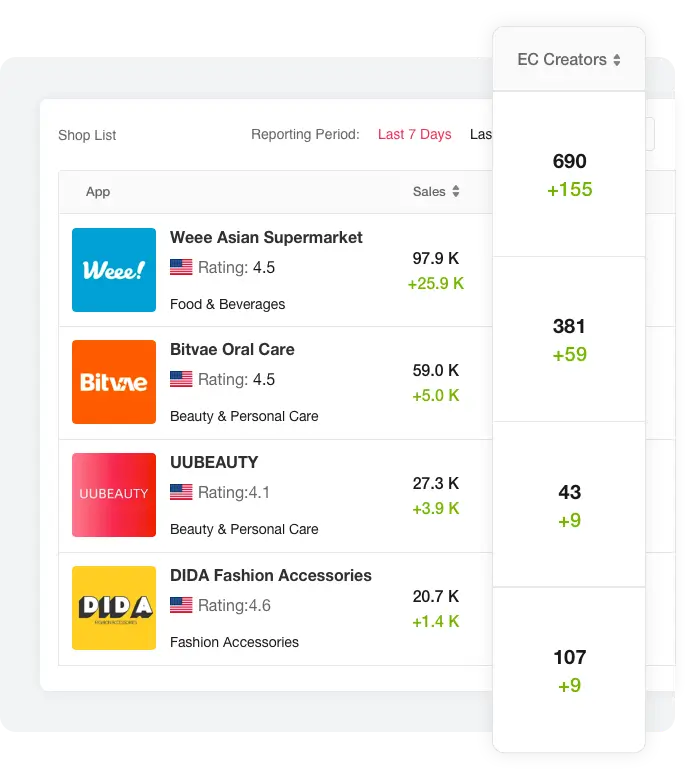

TikTok小店分析工具

让你获得10倍增长的TikTok数据

一站式TikTok数据分析平台

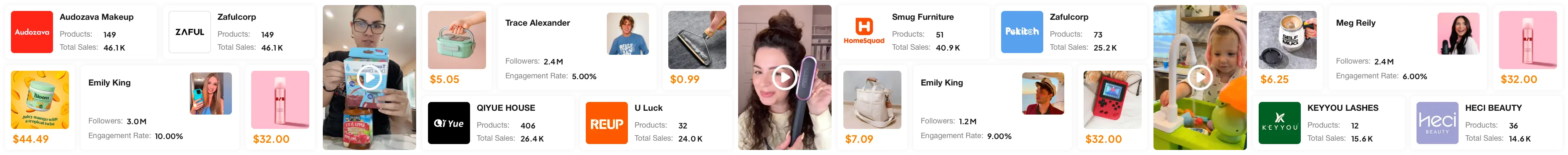

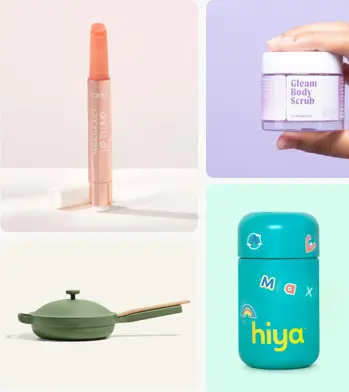

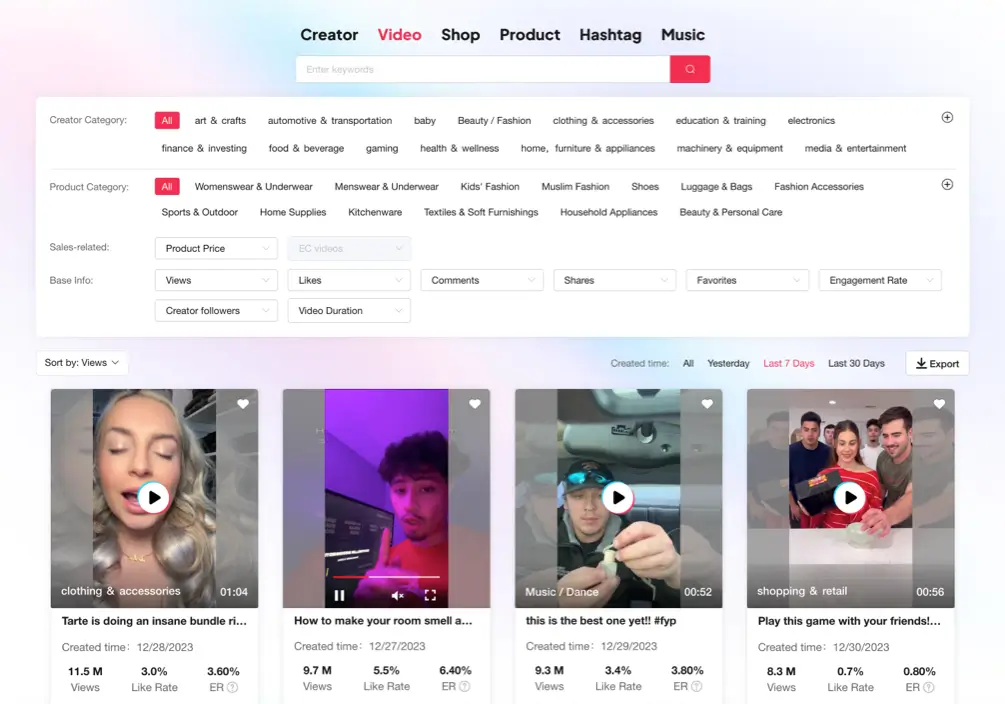

包含带货达人、视频素材、TikTok小店、爆款产品数据

注册免绑卡

为什么选择Tikstar?

适用对象:TikTok达人和小店卖家

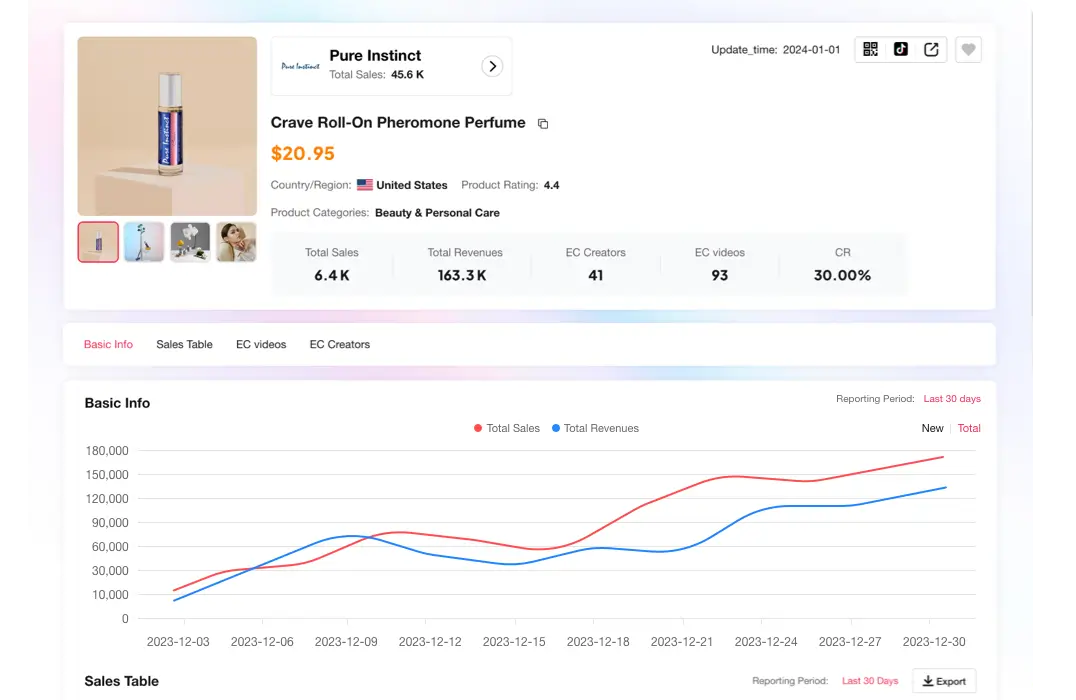

Tikstar协助你分析小店并发现爆款产品

Tikstar还有哪些特色功能?

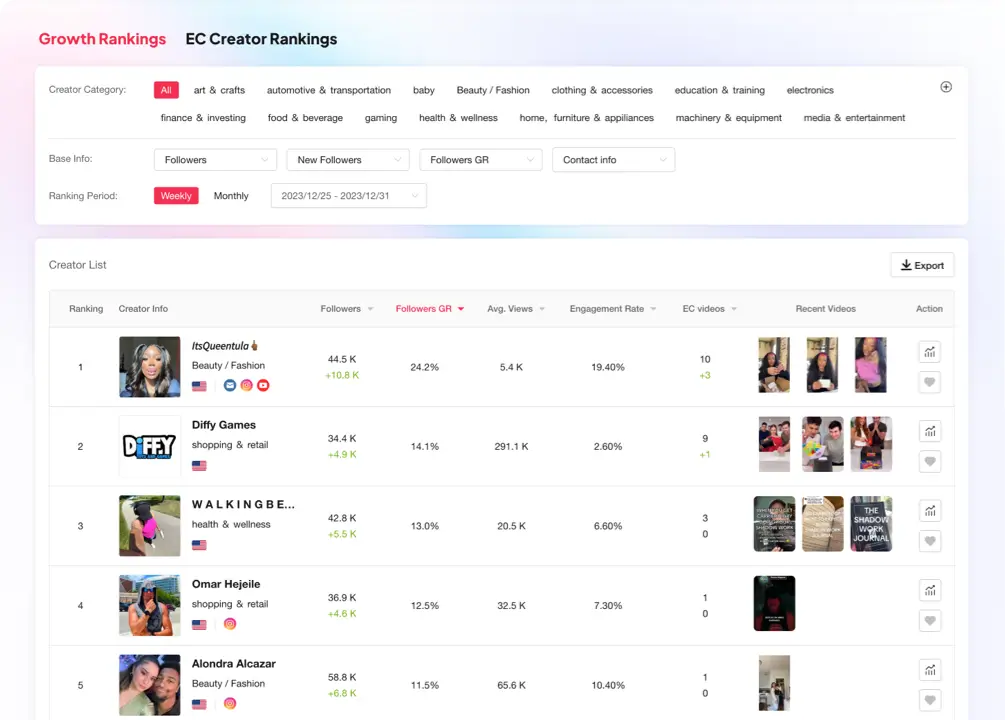

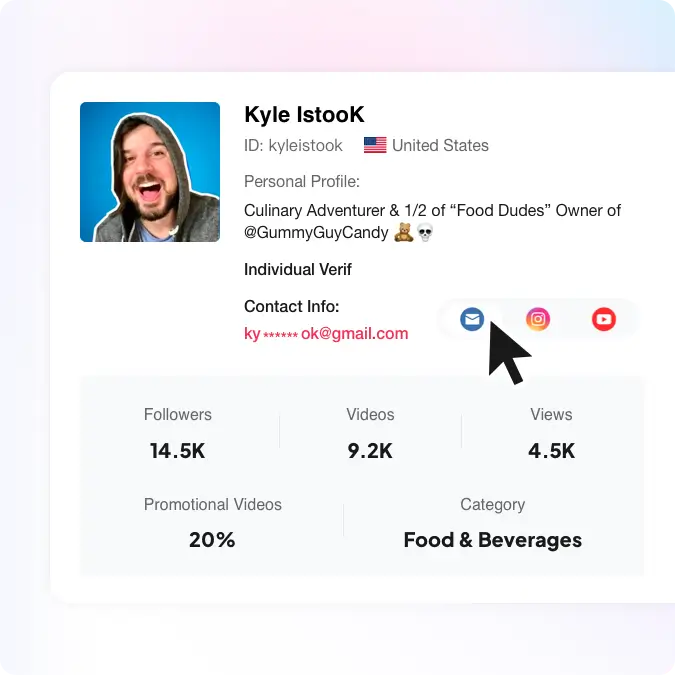

导出达人联系方式

提供达人的联系方式,包括邮箱、手机号、Ins、Twitter、YouTube等社媒账号信息。

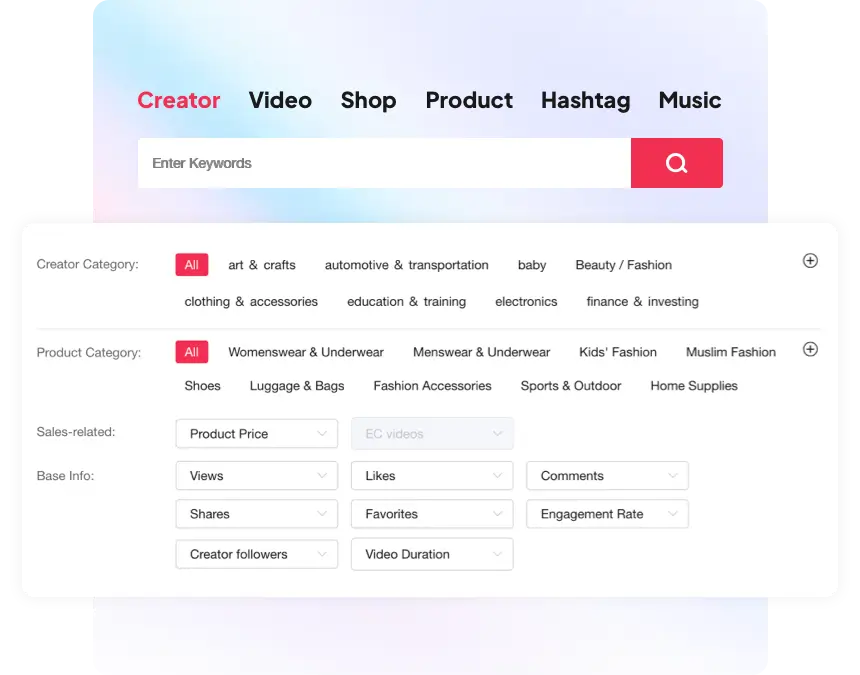

开始试用支持全方位多维的筛选功能

提供各种高效便捷的筛选维度,诸如价格区间、平均播放量、新增销量和增长效率等。

免费试用